PAY 0% TAX — LEGALLY.

Trusted ByEntrepreneursWorldwide

Our mission at Jones & Thomas

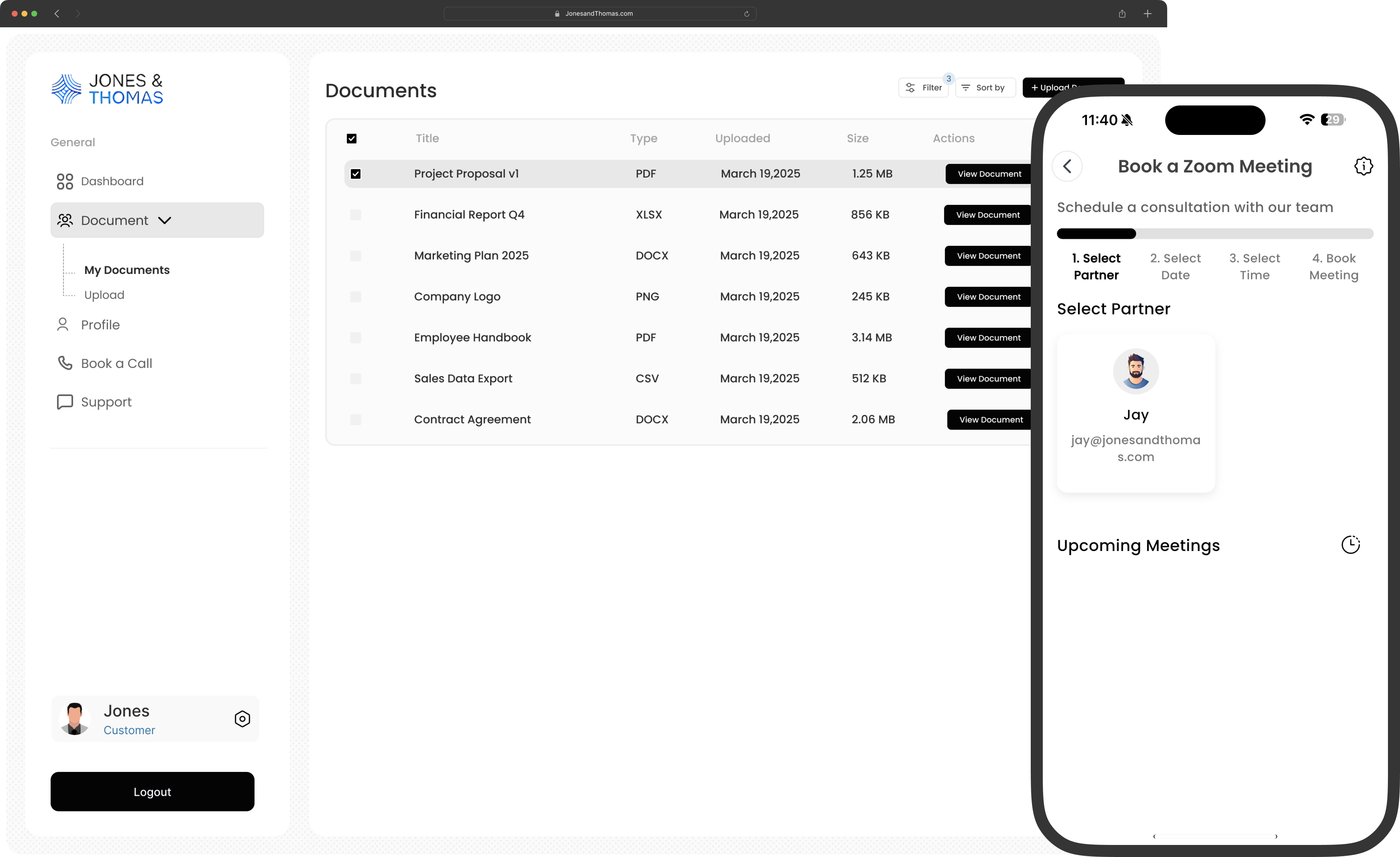

We understand how frustrating taxes can be, our mission is to provide clients with a streamline solution to easily manage their tax affairs, we use a custom built, secure software that documents and manages your every interaction ensuring you stay safe and compliant, whilst allowing you flexibility to work with multi jurisdiction, international tax specialists. Easily book free zoom calls with our specialists, and manage your important financial documents all in one secure easy to access portal.

Is Corporate Tax Draining Your Profits?

Imagine working hard all year — building your business, managing your team, taking risks, and finally turning a solid profit. But when tax season rolls around, nearly half of what you've earned vanishes. You've followed the rules, paid the accountants, and still, every year, you're left wondering: "How is this fair?"

That was James, a successful entrepreneur in London earning over £200,000 a year. Despite running a lean operation and reinvesting back into his company, personal taxes were draining his motivation. Bonuses were shrinking, and his family was feeling the pressure. His lifestyle didn't reflect the level of effort and success he had achieved. He wasn't living rich — he was living taxed.

That's when he discovered a smarter way. Not a loophole, but a structure — a better system used by the world's most strategic wealth-builders.

Contact Us Today!

Get in touch with our team for personalized assistance with your business needs.

Jay Jones

Our Socials

Ieuan Thomas

The Nexus Structure

The Nexus Structure is our proprietary solution designed for entrepreneurs and high earners who want to break free from traditional tax systems. It's a fully compliant 0% tax structure that legally eliminate personal tax and drastically reduce corporate tax exposure.

If you're earning over £100,000 / €100,000 / $100,000 a year, The Nexus Structure is your pathway to keeping more of what you earn and finally putting your wealth to work for you.

Trusted By Executives, TeamsAnd Professionals Globally

International Tax Advice

FAQ

Frequently AskedQuestions

We cater for all individuals at all levels, there is no such thing as too small, even if it's just a simple self assessment tax return we are here to help!